NAB have just released the latest Residential Property Survey for December 2018, with results falling to an all time low across all Australian states, but a positive outlook recorded for Perth and Western Australia.

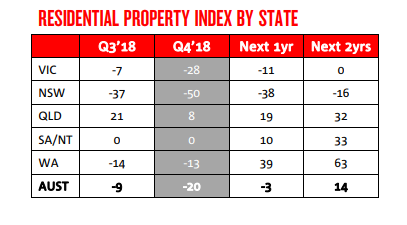

Image 1: Residential Property Index by State Table, sourced from the NAB Residential Property Survey Q4 2018.

- What is the NAB Residential Property Survey?

- Why is the overall Index so low?

- What’s the forecast for the housing market in Perth and Western Australia?

- Perth and WA rental market

- New developments market

- Established housing market

- What are the biggest constraints on the new and established markets?

What is the NAB Residential Property Survey?

In the Residential Property Survey, real estate professionals are asked to give their expert opinion about future capital growth (house prices) and rents. Their expectations are then quantified into the NAB Residential Property Index. This Index gives us an easy way to gauge if market sentiment is positive (“strong”) or negative (“weak”).

Over 3,000 property professionals participated in the survey for quarter four (Q4).

According to the Index for Q4, Australian housing market sentiment ended on a very weak note last year, plummeting from -9, to -20, and sitting well below its long-term average level (+12)...

Why is the overall Index so low?

NAB Chief economist Alan Oster said that the overall index was dragged down mainly by Victoria (down 21 to -28) and NSW (down 13 to -50) where downward pressure on prices intensified in Sydney and Melbourne.

This comes as no surprise, especially given that both Sydney and Melbourne ranked 3rd and 4th on the list of most expensive cities to live in around the world, according to the latest Demographia International Housing Affordability Survey. The number #1 and #2 spots went to Hong Kong in China, and Vancouver in Canada.

Perth (#20) was ranked the most affordable out of the five Australian Capital cities that made the list, compared to Sydney (#3), Melbourne (#4), Adelaide (#13) and Brisbane (#17).

What’s the forecast for the housing market in Perth and Western Australia?

Property professionals in WA continue to be the most positive about their local housing market in the long-term - and by a considerable margin - even though further small declines are predicted for Perth.

Comparatively, experts are predicting sharp house falls of around 15% in NSW and Victoria over the next 1-2 years.

WA is expected to lead the country for house price growth in 2 years’ time, although expectations dropped to 1.2% (from 1.8% in Q3). Perth prices have continued to weaken, ending the year 4.7% lower, and experts believe this is an ongoing adjustment, attributed to the large run up in housing supply during the mining boom.

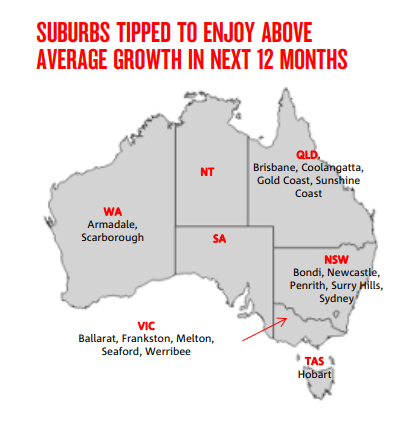

>>> suburbs tipped to enjoy above average growth in the next 12 months: Armadale and Scarborough.

Image 2: Suburbs Tipped to Enjoy Above Average Growth in Next 12 Months, sourced from NAB Residential Property Survey Q4 2018.

Perth and WA Rental Market

The outlook for rents are positive in all states (bar NSW) suggesting yields should trend higher. Property professionals in QLD lead the way for rental expectations (2.0% vs. 1.6% forecast previously), closely followed by WA (1.9% vs.0.8% forecast previously) which has also reportedly seen a drop in vacancies.

>>> The strongest rental growth is predicted in WA (3.1%) and this has improved from the last survey (2.0%).

New Developments Market

Owner occupiers accounted for 33.5% of new property purchases in Q4 2018, up from 32.4% in the previous quarter. Their market share fell in QLD (27.2% vs. 33.0%), SA/NT (35% vs. 40%) and WA (30% vs. 40%).

First home buyers (FHB) remain key players in new housing markets, and their overall market share increased to 39.7% in Q4 (38.7% in Q3).

>>> FHBs were most prevalent in WA and NSW with a market share of around 49% and 42% respectively.

Established Housing Market

More property professionals said the share of FHB owner occupiers (+33%) and resident owner occupiers (+23%) will increase than decrease in the next 12 months.

>>> The market share of owner occupiers was highest in WA (56.1%) followed by SA/NT (52.5%) and QLD (46.8%).

What are the biggest constraints on the new and established markets?

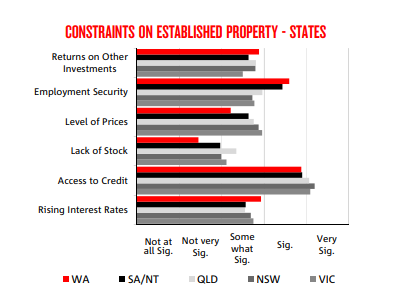

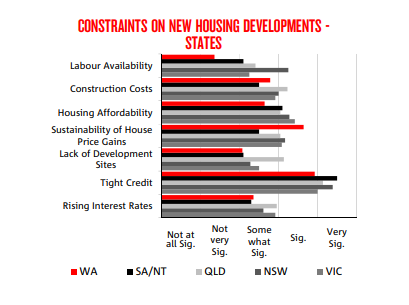

>>> All property professionals across Australia are citing the crackdown on credit and tighter lending restrictions as the biggest constraint on new housing development and biggest impediment for buyers of established housing.

Professionals classed its impact as “very significant” and causing more concern than at any time since the survey began.

Images 3 & 4: Constraints on New and Existing Housing, sourced from NAB Residential Property Survey Q4 2018.

The next biggest concerns in WA were employment security, housing affordability and sustainability of house price gains, followed by construction costs.

Click to read the full NAB Residential Property Survey here.

Want to know how much your property could sell for in this market? Call Brendan Leahy today on 0439 998 867 to book your obligation free market appraisal. He’d love to lend you his 12+ years of property expertise!

.png&w=70&h=70&zc=1&q=70&a=c)