In spite of the recent slowdown, the latest housing finance data shows investor activity in the housing market is on the increase again, with total returns from housing also looking very healthy.

The CoreLogic RP Data Accumulation Index (published since June 2009) highlights the total returns from residential property. The total returns include both the increase in values as well as gross rental returns.

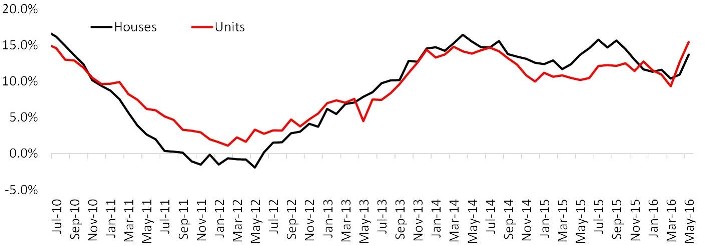

The first chart below displays the annual change in the total returns (accumulation) index over time. While combined capital city home values recorded longer and deeper falls during 2011-12, total returns were negative for only a short period of time thanks to the uplift from rental yields. More recently you can see that the annual change in total returns across the combined capital cities has remained quite strong.

Combined capital city annual changes in total returns for houses and units

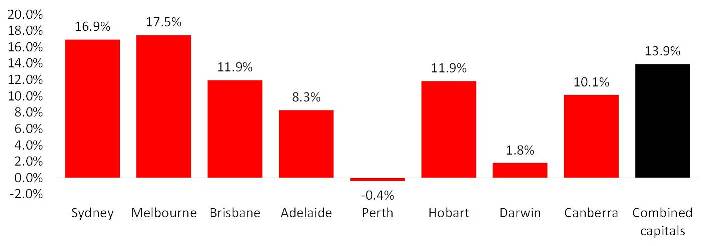

To the year ending May 2016, combined capital city home values have increased by 10% while total returns have been recorded at a higher 13.9%. Looking at the individual capital cities, all cities except for Perth have recorded positive total returns over the past year. Sydney and Melbourne which have been the most active investment markets have seen the highest total returns at 16.9% and 17.5% respectively over the past twelve months. It should be noted that gross rental returns in both of these cities are now at record lows highlighting that the majority of these returns have come via an increase in home values.

Annual change in capital city total returns, 12 months to May 2016

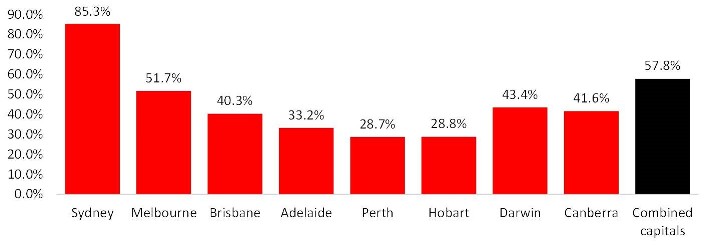

The third chart highlights the total returns over the past five years across all capital cities. Again, Sydney in particular, has seen far superior total returns compared to all other capital cities. Melbourne has also experienced relatively strong total returns over the past five years. In all other capital cities returns from residential property have been positive. In many of these cities the total returns have been driven more so by the rental returns rather than the capital growth which has been the key driver in Sydney and Melbourne.

5 year total change in total returns, to May 2016

Despite the recent rebound in value growth, the mature capital growth cycle and record low rental returns in Sydney and Melbourne, total returns are unlikely to be as strong in these cities over the coming years. A more balanced investment approach which focusses on moderate capital growth and relatively strong rental returns is likely to be a superior housing investment profile over the coming years. This data also highlights why housing investment has been so popular. In a low interest rate and subsequently low return environment housing has, over recent years, offered attractive returns. Whether this continues to be the case remains to be seen.

For the latest property market information visit the blog section of the Naked Edge Real Estate website.

.png&w=70&h=70&zc=1&q=70&a=c)