A decline in commodity prices and a lack of investment in WA’s mining towns continues to have an impact on property prices; however, not all mining towns have recorded an equivalent slowdown.

Research undertaken by CoreLogic provides a snapshot of just what’s been going in this sector in terms of the volume and median price of sales across these regions.

The smaller mining townships which don’t act as major service centres have tended to see a much sharper fall in median selling prices than the larger townships.

The decline in sales and prices from the market peaks has been substantial across all of these regions, however the regions that have seen the most significant downturn were those that also recorded a significant upswing in prices and turnover rates prior to the peak in commodity prices.

Research shows that most of the mining towns (listed below) have experienced a stabilisation in sales with some regions seeing an increase in sales volumes.

Although sales may have broken the declining trend in a number of areas, median selling prices are generally continuing to trend lower across each of the regions highlighted.

The improvement in transactional activity could potentially be due to larger numbers of distressed sales moving through these markets, but may also be attributable to a cautious return of buyers seeking out a bargain.

The challenge for many of these regions is that despite an uptick in commodity prices recently, investment in large infrastructure projects such as new mines, processing facilities and transport has dried up and subsequently few additional jobs are being created.

Although commodity prices have recently surged, particular iron ore, coking coal and thermal coal, it is not yet leading to a substantial increase in exploration activity or employment, subsequently housing demand remains weak and continues to have a dampening effect on housing prices.”

Key Mining Area Activity Snapshot:

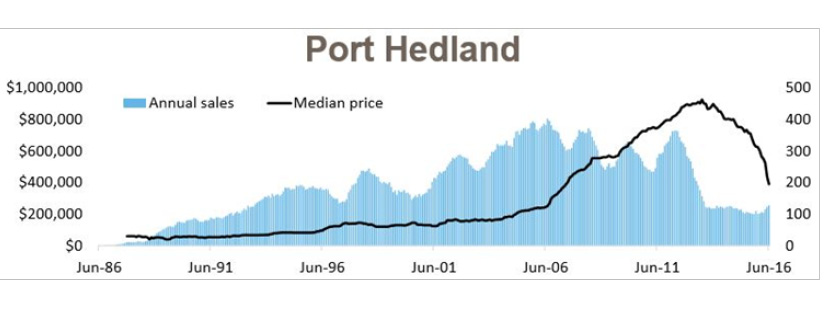

Port Hedland – median prices peaked at $925,000 in June 2013 and sales volumes peaked at 402 in July 2006.

Current median prices are $390,000 (-58% lower than peak) and current sales are 128 (-68% below peak).

In what may be a positive sign for the market, annual sales are once again trending higher, although the median prices trend is yet to bottom out.

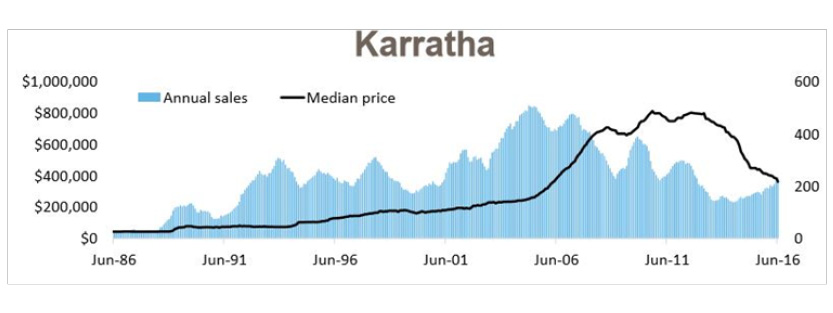

Karratha – median prices peaked at $815,000 in October 2010 and sales volumes peaked at 511 in March 2005.

Current median prices are $362,980 (-55% lower than peak) and current sales are 235 (-54% below peak).

Transaction numbers have been trending higher since xxx but the median sale price is still falling, albeit at a more moderate pace.

Kalgoorlie-Boulder – median prices peaked at $351,250 in June 2015 and sales volumes peaked at 1,656 in September 2006.

Current median prices are $312,000 (-11% lower than peak) and current sales are 345 (-79% below peak).

Transaction numbers appear to be levelling, however there is no sign of any upwards pressure on prices or turnover.

For the latest property market information visit the blog section of the Naked Edge Real Estate website.

.png&w=70&h=70&zc=1&q=70&a=c)