With many state governments making changes to their first home buyer policies to make home ownership more affordable, 2018 might be one of the best times for first home buyers to enter the market.

Despite property prices dipping and the introduction of policies which have reduced stamp duty for first time buyers, there are several factors to consider when it comes to buying your first home. With the average first home buyer price sitting at about $400,000 and the median house price in Sydney sitting around $1,000,000, your first home will likely be your biggest and most important purchase. Here’s what you need to consider when buying your first home in 2018.

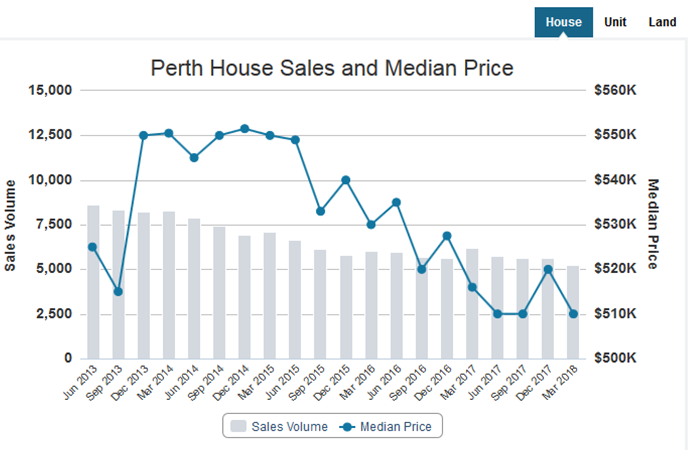

Here in Perth the median house sale price so far this year has sat at $510,000.

The Market

The property you purchase must obviously fall within your budget. A property that’s too expensive can leave you financially strained for years to come as you try to meet your mortgage repayments. This means you must do your research and find a property that not only meets your requirements, but is also within your budget.

Start by listing everything that your home must have such as the number of bedrooms, bathrooms, parking and location. Next, search online for suburbs with affordable property prices and houses with your needed features. This will help you get an idea of the current market within the locations you’re interested in.

Many people hope to purchase a house near their place of work, however, houses closer to the city can be significantly more expensive than homes in outer suburbs. If you can’t afford a home near your workplace, find more affordable suburbs with good public transport options.

The First Home Owners Grant

Most first home buyers are eligible for the first home buyers grant. The amount you can borrow will depend on what state you’re in and their first home buyer’s policy. The price of the home may also impact on the grant. To find out what you’re eligible for, visit the governments first home owners website.

Your Borrowing Level

Once you understand the market and the type of house you can afford, you need to establish your borrowing level. How much you can afford to borrow will largely depend on how much you earn and your living costs, as well as any existing debt and the size of your savings.

The best way to understand how much you can borrow is to visit a credible mortgage broker, like those at Brighter Finance. A mortgage broker can bring you tailored advice and help you through the entire home loan process, as well as negotiate with banks.

Repayments

Once you have a home loan, you will be making regular repayments on the loan. Before you agree to anything, it’s important that you determine if you will be able to afford the repayments.

Repayments can be made in weekly, fortnightly or monthly instalments and each way will have a different impact on your loan. As well as budgeting for the repayments themselves, it’s important that you budget for utilities, groceries and any other additional or unexpected expenses.

In addition to this, it’s important to consider that interest rates, as well as council rates can fluctuate. This means you should have some room for movement when it comes to your budget.

The Costs

The actual price of your home is only part of the expenses involved in purchasing a property. In addition to the price, there’s stamp duty, conveyancing fees, building inspections, as well as utility and council transfers. Moving costs should also be considered as well as any furniture you may need to purchase.

All of these fees and costs can add up, meaning the total cost of your new home can be a lot more than the price it is listed for.

The Community

When it comes to the house itself, it’s important that you consider the surrounding area and the lifestyle opportunities it presents. Everyone has a way of life that they enjoy, and some things will take priority over others.

Crime is a factor that many of us don’t think about but something that we all want to avoid. If you have children, good schools will obviously be important. On the other hand, if you’re a young couple, perhaps restaurants and nightlife will take the lead in deciding your property. Those who need to travel a lot for work might place a greater importance on public transport and infrastructure.

What’s important to you will depend on your own individual needs and preferences. Sites like Microburbs give you one place to check for all these things and more, making it incredibly easy to get a report for a location you’re interested in.

First home buyers have a lot to consider, but with the market cooling off and improved policies, 2018 could be the best time to get into the market before it booms again. Do your research, budget for your mortgage and choose an area you will be safe and happy in for a great first home buying experience.

.png&w=70&h=70&zc=1&q=70&a=c)