You don’t need a crystal ball to predict what’s ahead for our property markets, as they typically move in a rather predictable cycle. This generally consists of four stages; boom, downturn, stabilisation, then upturn.

What factors affect the property cycle?

The main factors driving the property cycle are:

-

Interest rates and the availability of funds to buy property – when money is cheaper (interest rates are low) this is positive for property markets.

The Economy – business confidence, employment prospects, jobs growth and wages growth all create demand.

The availability of supply of property to meet this demand.

Consumer confidence

Demographics – in particular the creation of households (again affecting demand).

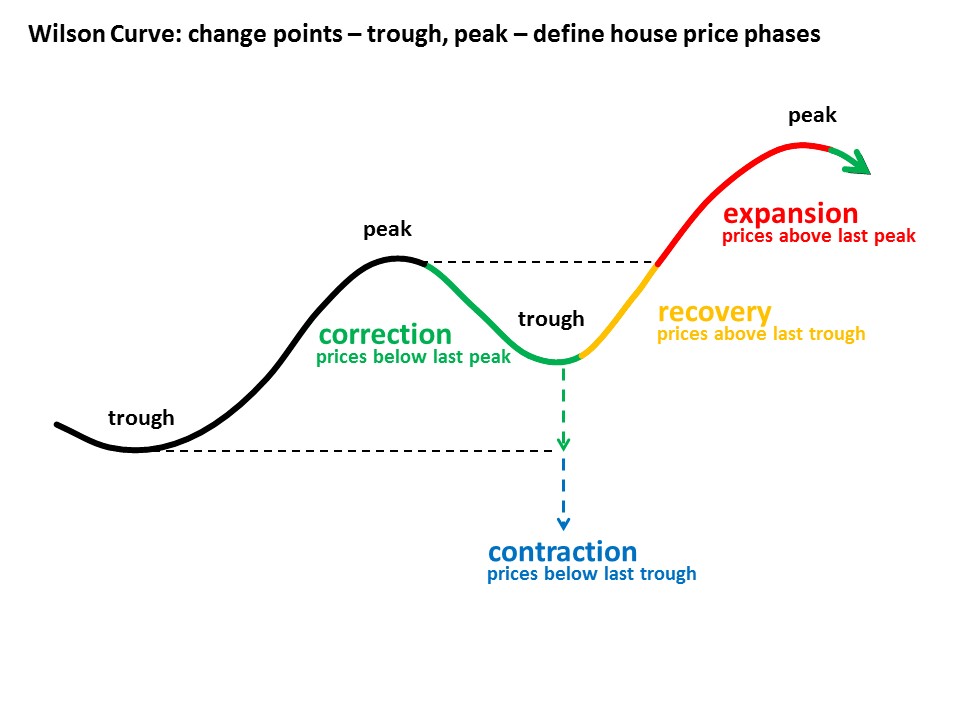

A new way of looking at things – the Wilson Curve

A fresh spin on the standard cycle pattern is the Wilson Curve, developed by Dr Andrew Wilson, one of Australia’s leading housing market experts.

His model provides a very different perspective of what’s going on at each stage of the property market cycle. Click here for a quick 30-second video explaining the Wilson Curve.

The Wilson Curve consists of:

- The Correction Phase - House prices are below the previous price peak of the cycle, yet above the previous price trough of the cycle.

- The Contraction Phase - House prices are below the previous price trough of the cycle.

- The Recovery Phase - House prices are above the previous price trough of the cycle, yet below the previous price peak of the cycle.

- The Expansion Phase - House prices are above the previous price peak of the cycle.

So what does this all mean?

Understanding the property cycles means you can better predict what will happen to property prices in the future, based on historical trends.

By purchasing and selling at the optimal times in the market, you’re better able to maximise your profits and minimise your losses, something everyone is looking to do in the real estate game!

To keep up to date with the latest property market information, check out the blogs section of the Naked Edge Real Estate website.

.png&w=70&h=70&zc=1&q=70&a=c)